Many experts have pointed out that emotions play a crucial role in the cryptocurrency market. The primary market movements are largely influenced by the sentiments of crypto investors. Therefore, to successfully operate and profit in this environment, one must understand and monitor these emotional shifts. Let's explore the Cryptocurrency Fear and Greed Index and its significance.

UNDERSTANDING THE CRYPTOCURRENCY FEAR AND GREED INDEX

This index combines multiple analytical components to evaluate market conditions. It specifically monitors five key market aspects:

The rate of price fluctuations (cryptocurrency volatility) Market activity (quantity of cryptocurrencies being traded) Expert opinions (evaluations from various specialists and analytical platforms) Market dominance (individual cryptocurrency's share in the total crypto market) Social media presence (cryptocurrency mentions and searches on platforms like Google and Twitter) As a reference point, Thomson Reuters is developing an AI-powered sentiment tracking system capable of processing 400 distinct market indicators.

PRACTICAL APPLICATION OF THE FEAR AND GREED INDEX

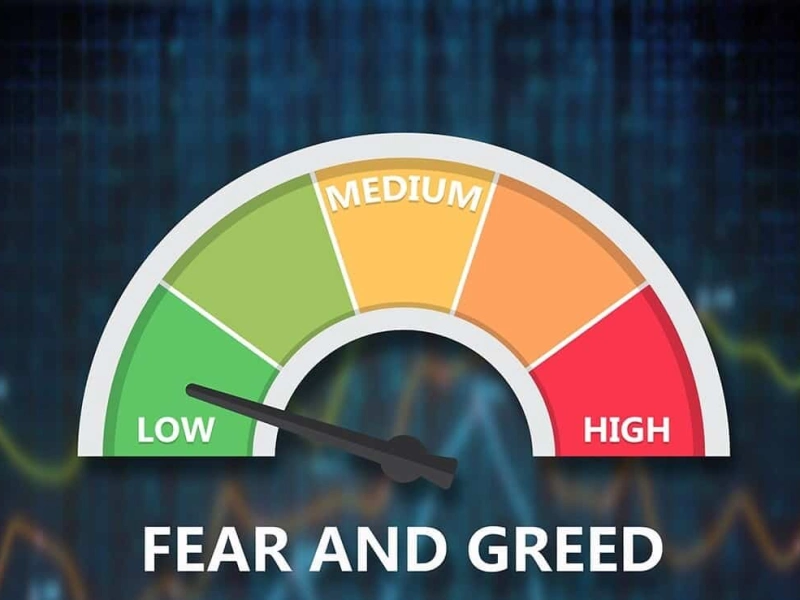

The index typically presents its findings on a scale of 0-100, where 100 represents extreme fear and 0 indicates extreme greed. This tool offers two main benefits for traders:

It helps maintain objectivity in trading decisions. Understanding the prevailing market sentiment allows traders to better control their emotional responses and make more rational choices.

It serves as a valuable indicator for timing market entry and exit:

During periods of extreme fear, when investors are highly anxious, it often signals a buying opportunity as prices are likely to recover. Conversely, extreme greed usually indicates that investors are rushing to sell for quick profits, suggesting an upcoming market correction.

By understanding these collective market emotions, traders can enhance their trading strategies and potentially increase their profitability.

- Cryptocurrencies in Islam: Halal or Haram?

- Platforms for issuing tokens: Where to mint coins for ICOs?

- Hybrid cryptocurrency exchanges: what is HEX?

- What is cryptojacking and how to escape from it?

- How to Know Mining: Key Terms

- The best software miners for a quick start

- Creating a blockchain with your own hands in Python

- What are parachains?

- What is NFT?

- What is Bitcoin?

- How to assemble a rig for mining with your own hands