The cryptocurrency market experienced high volatility in January, driven by the launch of Exchange-Traded Funds (ETFs) at the beginning of 2024.

Bitcoin saw a price increase of approximately 2% in January. However, the month was characterized by significant volatility, influenced by the entry of spot exchange-traded funds (ETFs) into the market and the capital flows into these funds.

This marks the fifth consecutive month of positive performance for Bitcoin. The last time a similar trend was observed was from October 2020 to March 2021, when prices in both the stock and cryptocurrency markets were boosted by stimulus payments to the population. In 2023, Bitcoin experienced a price surge of over 150% in anticipation of the long-awaited launch of spot ETFs in the United States.

Market participants anticipated that the launch of ETFs by companies such as BlackRock or Fidelity Investments would bring significant capital inflows into the cryptocurrency. According to Bloomberg, the new ETFs collectively attracted over $1 billion in capital on the first day of trading. The Bitcoin fund group was reported to have the most successful launch in the history of the entire ETF market.

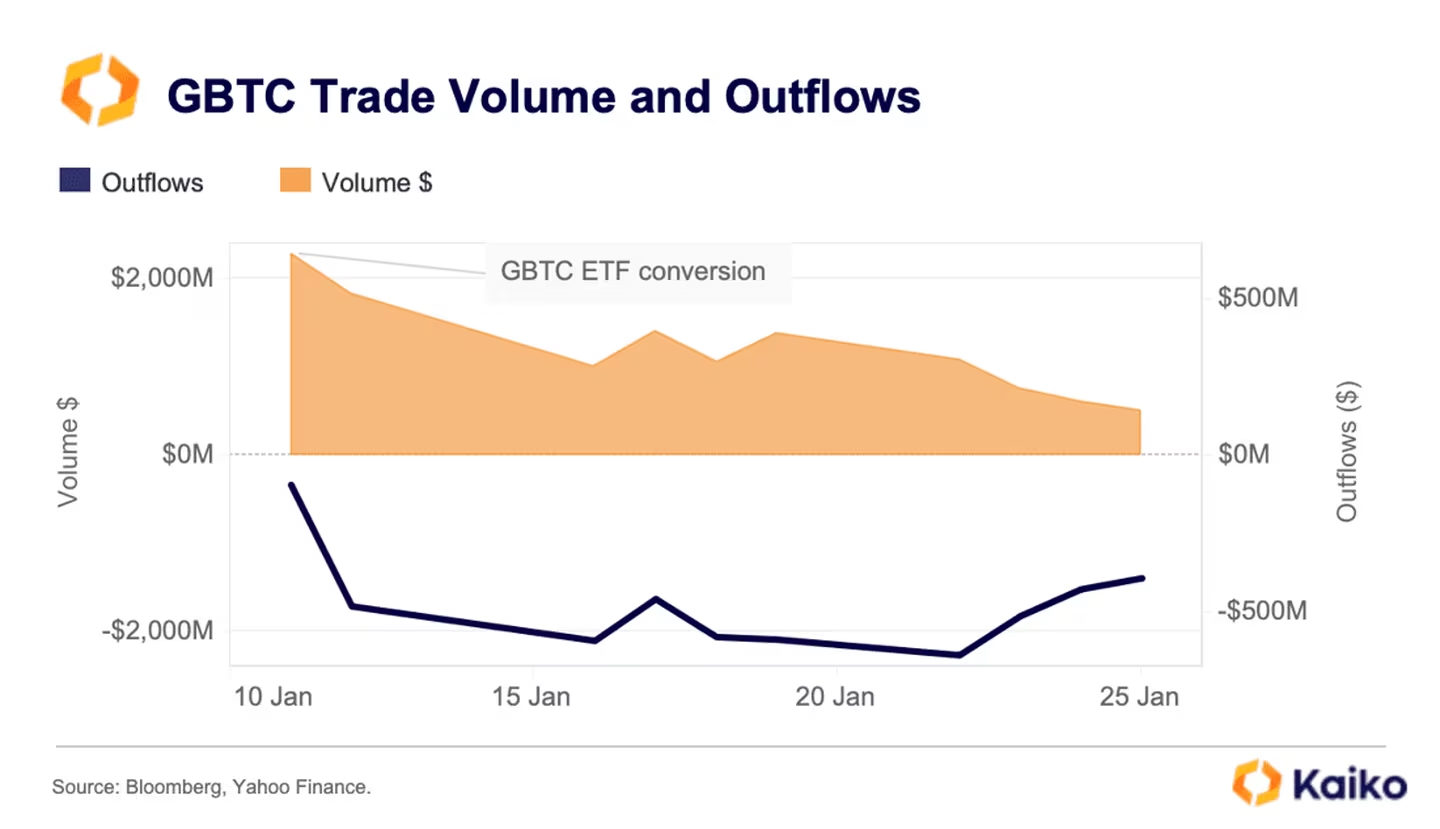

However, after the start of trading of the new ETF shares on exchanges, the price of Bitcoin fell by more than 20% over 12 days. One of the funds, Grayscale Bitcoin Trust (GBTC), was converted into an ETF from a closed trust launched a decade ago. Following the conversion, investors began massively withdrawing assets daily, coinciding with a gradual decline in the price of Bitcoin. By the end of January, the pace of fund outflows from GBTC slowed down, helping the cryptocurrency recover from losses.

After dropping from a peak of $49,000, Bitcoin appreciated by 10% by the end of the month. From January 25th, BTC rose from $39,900 to $43,300, according to data as of January 31st.

Sean Farrell, responsible for digital asset strategy at Fundstrat Global Advisors, referred to the slowdown in fund outflows from Grayscale Bitcoin Trust as a "significant positive factor for market sentiment." Grayscale Bitcoin Trust is the largest of the approved funds with assets under management totaling $20.8 billion.

Since January 11th, when ETF shares began trading on exchanges, fund outflows from GBTC amounted to around $5 billion. Unlike public addresses of the fund's crypto wallets tracked by analytical services, specific investor actions are not openly available. Journalists from Coindesk found that the current leadership of the bankrupt crypto exchange FTX and its associated companies and funds is behind selling the fund's assets for at least $1 billion.

Furthermore, after Grayscale's fund conversion to an ETF, early investors took advantage of the opportunity to exit their positions in GBTC. This also contributed to the fund outflows. These investors held fund shares at a significant discount to the value of Bitcoin as the underlying asset, paying a high commission and not realizing losses in anticipation of the fund obtaining ETF status.

Currently, according to data from the analytical company Kaiko, the outflow averages around $500 million per day.

"The good news is that trading volumes and outflows show signs of slowing down, providing much-needed support for Bitcoin," write analysts at Kaiko in their weekly report. "While the outflow from GBTC was expected and partially offset by inflows into other recently launched spot ETFs, the impact on market sentiment was truly significant."

Graph of fund outflows from GBTC. Source: Kaiko

ETF market analyst at Bloomberg, James Seyffart, citing internal data, wrote on X (formerly Twitter) that on January 30th, daily outflows from GBTC decreased to $191.7 million.

"ETFs themselves are not the market," Seyffart wrote. "Yes, they make up a big piece of the pie now, but there's still a lot more. Inflows into Bitcoin ETFs can coincide with a drop in Bitcoin prices. Outflows can coincide with a rise."

Kaiko analysts similarly raise questions about the impact of activity in new ETFs on the market, particularly whether they represent an influx of new capital into the market or simply a switch among investors between investment products. A clearer picture is expected to emerge in the coming months.