Bitcoin Demand from ETFs in June Surpassed Miners' Capacity

The demand for bitcoin from ETFs in June exceeded the capabilities of miners. Amid the longest period of inflows in history, ETFs increased their bitcoin purchases.

In the first week of June, bitcoin ETFs in the US bought eight times more bitcoins than were mined by miners, spending $1.83 billion. From June 3 to 7, 11 exchange-traded funds bought 25,729 bitcoins, while only 3,150 bitcoins were mined during the same period.

According to HODL15Capital, the volume of bitcoins acquired in June was almost as much as the entire amount purchased in May — 29,592 BTC.

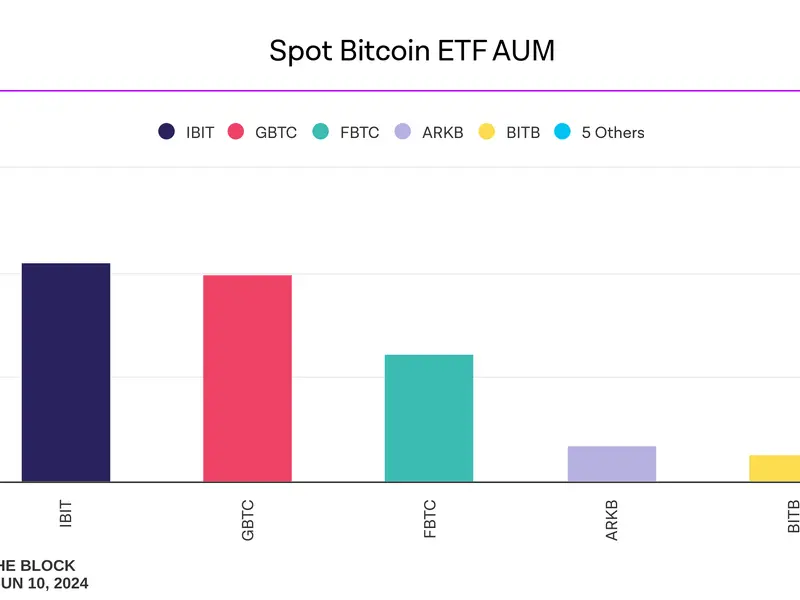

Capital inflows into American spot bitcoin ETFs continued for 18 consecutive days, marking the longest period of inflows in history. The net inflow of funds since the beginning of the year has increased to $15.5 billion. The total value of assets under management by the 11 US bitcoin ETFs reached $61.1 billion, approximately 4.47% of the existing coins.

The volume of assets under management by bitcoin ETFs has reached 60% of that of gold ETFs, despite gold exchange-traded funds having been in the market for about 20 years, whereas bitcoin ETFs were introduced just five months ago. This was noted by the president of ETF Store, Nate Geraci.

A record inflow of funds into spot bitcoin ETFs — over $1 billion — was recorded during the trading session on March 12. The second-largest daily investment inflow in the history of bitcoin funds was recorded on June 4 — $887 million. According to Cointelegraph, bitcoin reaching the $71,000 mark on June 5 coincided with investment inflows into the funds.

An important factor influencing the dynamics of the crypto market remains US inflation. Experts at 10x Research, led by Marcus Thielen, cited unemployment data along with other macroeconomic indicators as key conditions for bitcoin reaching a new high.

To confirm his forecast for bitcoin growth, Thielen expects the publication of the US Consumer Price Index (CPI) on June 12. A CPI decrease of 0.1%, to 3.3% or below, as it was in May, could become a catalyst for a new bitcoin rally. In May, after the CPI decreased by 0.1%, the first cryptocurrency rose by 7% within five days, reaching $71,400.