JPMorgan Bank Questions the Sustainability of Bitcoin Inflows

Experts at the bank consider investments in Bitcoin funds as capital transfers from cryptocurrency exchanges.

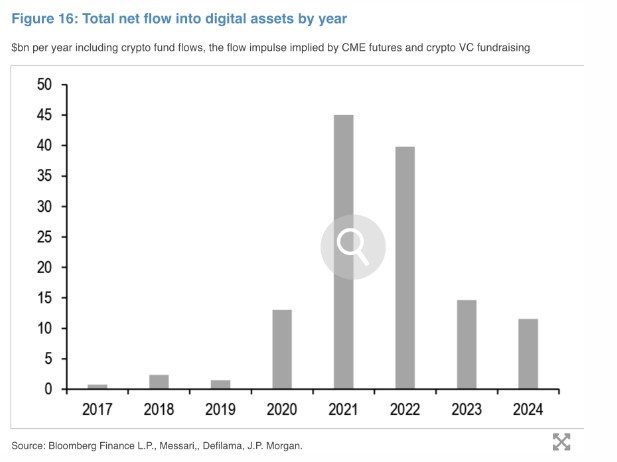

Analysts at the world’s largest investment bank, JPMorgan, doubt the continuation of the current level of fund inflows into cryptocurrency. According to them, the "high price of Bitcoin both in relation to its mining cost and to the price of gold" could lead to a slowdown in investment growth. If the current trend continues, the net annual inflow of funds into crypto assets will be around $26 billion, the experts calculated.

Bitcoin continues to experience selling pressure, trading below its May highs. As of 19:22 Moscow time on June 13, the Bitcoin price on the Binance crypto exchange is $66,500 in pair with the stablecoin USDT. The first cryptocurrency lost about 4% in value over the past day. The price drop occurred after it became known that on June 12, the U.S. Federal Reserve (Fed) kept the key rate unchanged at 5.25-5.5%.

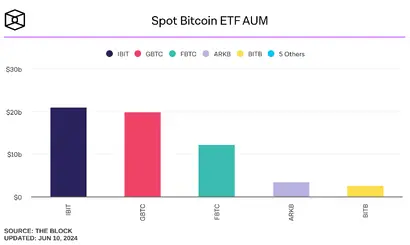

In the first half of 2024, investors put about $16 billion into crypto assets. According to experts, this was due to the launch of spot exchange-traded funds (ETFs) for Bitcoin in the U.S. Considering indirect inflows through futures trading on the Chicago Mercantile Exchange (CME) and investments in cryptocurrency venture funds, the total inflow into cryptocurrency reached $25 billion.

Despite the impressive numbers, JPMorgan analysts believe that not all these funds are "new money" entering the market.

Analysts think that many investors have shifted from trading Bitcoin on crypto exchanges to investing in spot Bitcoin ETFs due to their liquidity and transparent regulatory status. Since January, when the first Bitcoin ETF was launched, Bitcoin reserves on exchanges have decreased by 220,000 BTC (about $13 billion), according to CryptoQuant data. The net inflow of investments into cryptocurrency assets overall to date is about $12 billion.

Net inflow into digital assets. Source: The Block

In March, JPMorgan analysts published a report stating that the impact of fund inflows into exchange-traded funds was exaggerated. Experts said that the inflow into spot Bitcoin ETFs mainly represents a capital transfer from crypto exchanges. According to the report, besides retail investors, hedge funds also actively participated in the Bitcoin rally from February to mid-March.

Experts also refuted conclusions that the rise in the price of the first cryptocurrency to a new all-time high was due to investors switching from gold to Bitcoin.

In May, the U.S. approved the launch of exchange-traded funds for Ethereum and the listing of their shares on NASDAQ, NYSE, and CME. The start of trading in Ethereum fund shares requires final approval of the issuers' documents by the exchange regulator.

According to Fox Business reporter Eleanor Terrett, SEC Chairman Gary Gensler expects final approval of company applications for the launch of spot ETFs based on Ethereum in the U.S. by the end of summer.

The launch of such ETFs for Bitcoin in the U.S. triggered a capital inflow into the market and became one of the catalysts for cryptocurrency price growth in 2024.