JPMorgan says Ethereum has become more centralized and gives the reason why

JPMorgan: Ethereum network has become more centralized due to interest in stacking

The rise in validators has also resulted in lower returns on stacking, while the returns on traditional financial assets have risen as well

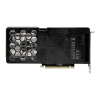

Analysts at JPMorgan expressed concern about the increasing centralization and declining profitability of staking in Ethereum due to the surge of interest in it, caused primarily by the decentralized liquid staking protocol Lido. Staking involves locking cryptocurrency assets in the network to generate passive income, while liquid staking offers derivative tokens in exchange for secured cryptocurrency holdings that can be used in various DeFi transactions.

In September 2022, the Ethereum network transitioned to a proof-of-stake (PoS) mechanism. This transition, as well as the Shanghai update, allowed validators to withdraw and reinvest blocked altcoins, leading to a significant increase in staking activity.

However, as JPMorgan emphasizes, there has been a price to pay for this increase in staking. The Ethereum network has become more centralized, with more than 50% of blocked coins controlled by the five largest liquid betting providers, among which Lido is a major player. Despite their decentralized nature, platforms like Lido are highly centralized, which poses risks to the Ethereum network. The concentrated number of liquidity providers or node operators could become a vulnerability, and they could collude to advance their interests at the expense of the community, which could lead to censorship of transactions.

If the value of the stub fund drops dramatically or is compromised due to malicious attacks or bugs in the protocol, it could trigger a cascade of liquidations.

In addition, Ethereum staking yields have fallen from 7.3% per annum prior to the Shanghai Update to around 5.5% currently. This decline in staking yields contrasts with the rising yields of traditional financial assets.

- Grayscale has filed an application to convert the Ethereum Trust into an ETF

- FTX book author tipped off about the idea of giving Trump $5 billion for refusing to run for office

- Co-founder of bankrupt crypto fund Three Arrows Capital detained in Singapore

- WSJ: Crypto-industry participants have started to prepare for the collapse of Binance

- Binance is leaving Russia. Why it happened and what to do for its users

- SEC once again postpones bitcoin-ETF decision

- CommEX warned of fraudulent projects with similar names to it