Justin Bieber's $1.3 million NFT has fallen 22 times in value

Justin Bieber's $1.3 million NFT bought by Justin Bieber has fallen 22 times in 1.5 years

80% of tokens from the once-popular collection never sold in 2023

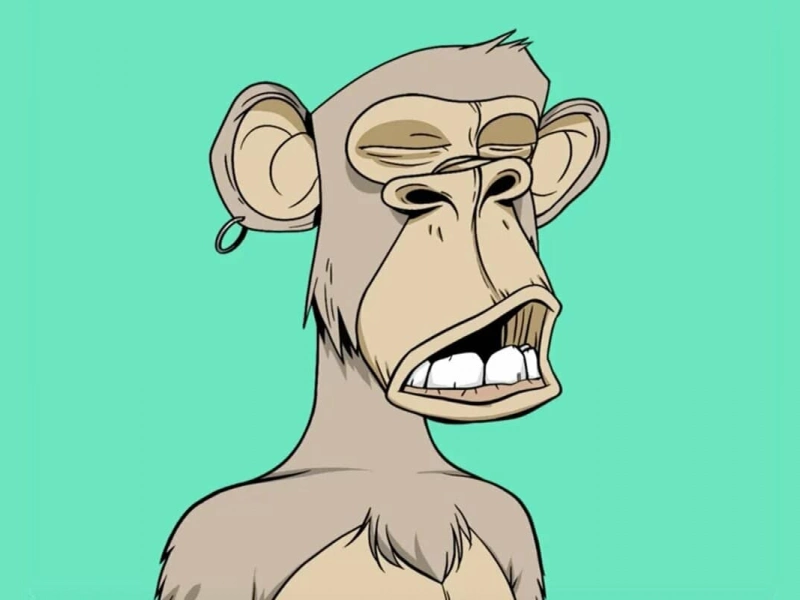

Justin Bieber's $1.31 million NFT from the Bored Ape Yacht Club (BAYC) collection has fallen in price to $57,000 (22 times). Singer purchased the token in January 2022, three months before the BAYC collection reached its peak.

NFT number 3001 of the 10,000 token series Bieber bought for 500 ETH. That token is now worth about 29 ETH on the Opensea platform. It's not the most expensive NFT of the bored monkeys - there are at least four items for sale priced at least 1k Ethereum ($1.9 million as of July 4) and dozens of tokens more expensive than 100 ETN.

Despite individual expensive offers, the minimum price of NFT BAYC (the lowest price of one NFT in the collection, floor price) fell by almost 78% from its peak value. It was recorded at 153.7 ETH on May 1, 2022, and is now only 32.9 ETH ($61,54k).

BAYC aren't the only tokens whose prices have fallen. NFTs from the Doodles, Azuki, and CryptoPunks series have also fallen markedly in price. Market participants have lost interest in buying.

More than 80% of NFTs in leading collections such as Bored Ape Yacht Club and CryptoPunks "were never sold in 2023," according to NFT market observer NFTstats.eth. In the BAYC collection, 83.1 percent of tokens have remained unmoved for the past six months.

- Mastercard is preparing an experiment with tokenized bank deposits

- $11.5 billion in cryptocurrency lost in 2022 due to hacks and fraudsters

- Russia has caught up with the U.S. in the growth rate of cryptocurrency mining

- Cryptocurrency Bitcoin Сash tripled in ten days

- Bitcoin plummeted to $29,700 after news of ETF rejection

- Investment idea: Buying Litecoin amid the launch of EDX Markets

- Thailand, Singapore, and South Korea publish cryptocurrency regulations

_410x245_00e.webp)