Companies Reveal Investments in Bitcoin ETF Stocks: Who Bought and How Much

Morgan Stanley Joins the Ranks of U.S. Bitcoin ETF Shareholders

Several companies and hedge funds in the U.S. have disclosed their investments in spot Bitcoin ETF shares in their quarterly reports.

Spot Bitcoin ETFs in the U.S. have experienced a fourth consecutive day of investor inflows. The total daily capital inflow on May 16 exceeded $257 million.

Spot ETFs, which involve the actual purchase of cryptocurrency to back the fund's shares, have driven capital into the market and have been one of the catalysts for Bitcoin's price increase in 2024.

In May, American financial companies and hedge funds began revealing their investments in Bitcoin ETFs in their quarterly reports. According to Bloomberg Intelligence ETF analyst Eric Balchunas, over 500 different organizations have acquired shares of spot Bitcoin ETFs. For instance, Millennium Management reported purchasing shares of several cryptocurrency ETFs worth $2 billion, representing 3% of the fund's total assets of $64 billion.

As of the end of March, one of the world's largest investment banks, Morgan Stanley, held Bitcoin ETF shares worth more than $270 million. The Wisconsin State Investment Board disclosed its investments in exchange-traded funds totaling $163 million, distributed between BlackRock's (IBIT) and Grayscale Bitcoin Trust (GBTC).

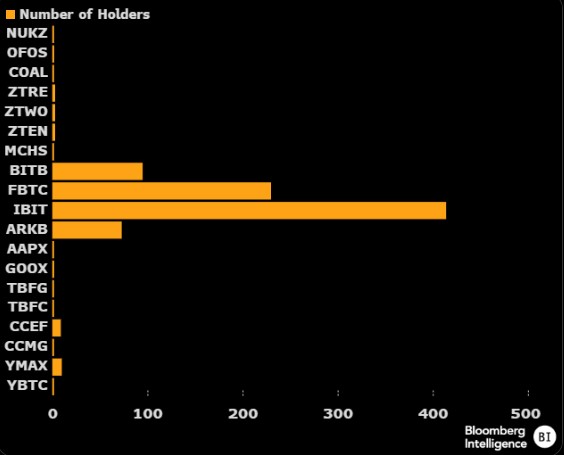

**Corporate Holders of Bitcoin ETF Shares. Source: Bloomberg**

BlackRock's IBIT spot ETF leads in the number of investors. According to Balchunas, IBIT has 414 investors, which is an "outstanding" figure for such an investment product. "For newly launched ETFs, even having 20 holders is a big success," noted Eric Balchunas. He emphasized that BlackRock's fund "is breaking all records," demonstrating significant interest in Bitcoin from institutional investors.

The analyst also highlights the diversity of investors who have put money into the fund. Among them are hedge fund managers, investment advisors, private investment firms, pension funds, brokerage firms, banks, trusts, insurance companies, holding companies, and family offices.

Nearly 69% of IBIT fund shares are held by hedge fund managers, and 22% by investment advisors.

"Typically, such a wide range of holders appears only years after a product's launch when it achieves significant liquidity, which IBIT already possesses," says Balchunas.

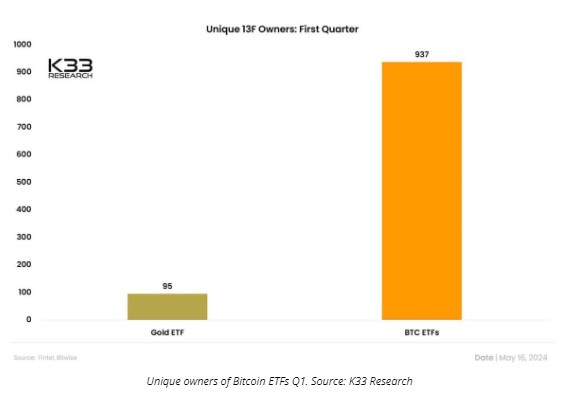

In March, Matt Hougan, CFO of Bitwise, predicted that by the end of the first quarter, approximately 700 institutional companies in the U.S. would disclose investments in cryptocurrency ETFs totaling around $5 billion. For comparison, in the first three months, 95 institutional investors invested in gold ETFs.

**Number of Investors in Gold and Bitcoin ETFs in the First Quarter After Launch. Source: K33 Research**

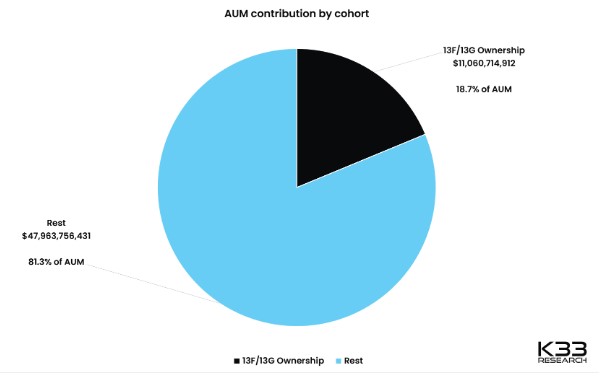

The total assets under management of exchange-traded funds as of May 17 stand at $54 billion. However, according to K33 analysts, the share of professional investors in the total investment volume remains low. Experts estimate that by the end of the first quarter, it was only 18.7%, or $11.06 billion.

**Ownership Structure of Bitcoin ETF Shares. Source: K33 Research**

_410x245_00e.webp)