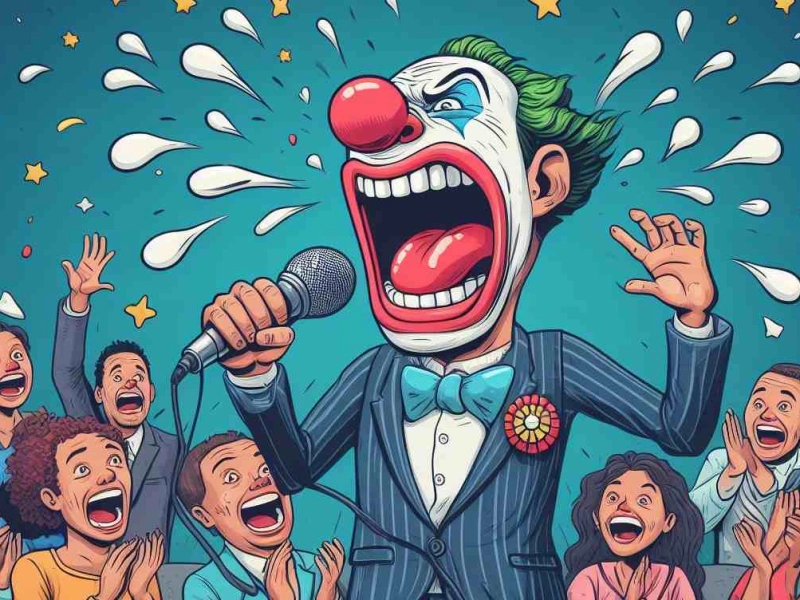

SEC chief says crypto industry full of fraud and con artists

The head of the SEC said that the crypto industry is full of fraud and con artists

According to Gary Gensler, cryptocurrency companies are required to obey the same rules as traditional financial institutions

Chairman of the U.S. Securities and Exchange Commission (SEC) Gary Gensler said that the crypto industry is "swarming" with fraudsters and con artists. The SEC head recalled that the industry has faced a lot of negative events in recent years, including such events as the collapse of one of the largest exchanges FTX, the bankruptcy of Three Arrows Capital, and the fall of algorithmic stablecoin Luna. According to Gensler, these problems are not surprising, The Block reports.

"This field is rife with scammers, and con artists, it's full of bankruptcies and examples of money laundering. While many in this industry claim to operate outside of regulation, they are very willing to go to bankruptcy court and to resolve their private disputes," Gensler said.

The head of the commission maintains his previous attitude towards the digital asset industry and believes that cryptocurrency companies should be subject to the same rules as traditional financial institutions. Gensler made his stance amid heated discussions about the status of pending Bitcoin-ETF applications.

"There are no factors that would indicate that investors and issuers of cryptocurrency assets are any less deserving of the protections of the Securities Act. In 1933 or 1934, Congress could have said that the securities laws applied only to stocks and bonds. However, Congress included a rather long list of items within the meaning of security, including an investment contract," Gensler said.

To determine whether an asset is a security, the SEC uses the criteria of the so-called Howey test. The test, created by a 1946 Supreme Court decision involving Florida citrus plantation deals, is the basis of the SEC's authority to monitor securities that are considered "investment contracts" and do not fall into familiar categories such as stocks and bonds.

Although the concept originated in the middle of the last century, the agency still applies it to actual assets, including cryptocurrencies. Due to the fact that the U.S. has yet to develop a unified regulatory approach to cryptoassets, it is one that could ultimately shape the landscape of cryptocurrency regulation.

The U.S. Securities and Exchange Commission (SEC), under the leadership of Chairman Gary Gensler, is actively ramping up the pressure on the cryptocurrency industry. The main U.S. exchange regulator has already filed lawsuits against two major cryptocurrency exchanges - Binance and Coinbase. The agency makes a number of accusations against both exchanges, the main of which is the recognition of a number of cryptocurrency assets that are traded on the platforms as unregistered securities that fall under the jurisdiction of the regulator.

In June this year, the head of the SEC compared the cryptocurrency industry to the US stock market of the 1920s, full of "hustlers and swindlers."

- Bitcoin's market share hits 2-year high

- The U.S. Treasury Department has accused all existing cryptomixers of money laundering

- BlackRock and Grayscale file updated bitcoin-ETF filings

- Ferrari has started accepting payment for cars in cryptocurrencies at the request of customers

- QCP Capital analysts doubt Bitcoin's growth this year

- Experts call cryptocurrencies' role in supporting terrorism exaggerated

- Intel processor tests for 14th-generation desktops have appeared.