The income indicator for Bitcoin mining has approached its historical minimum.

The profitability indicator of Bitcoin mining decreased after the halving. The reduction in block rewards has affected the key profitability indicators of Bitcoin mining.

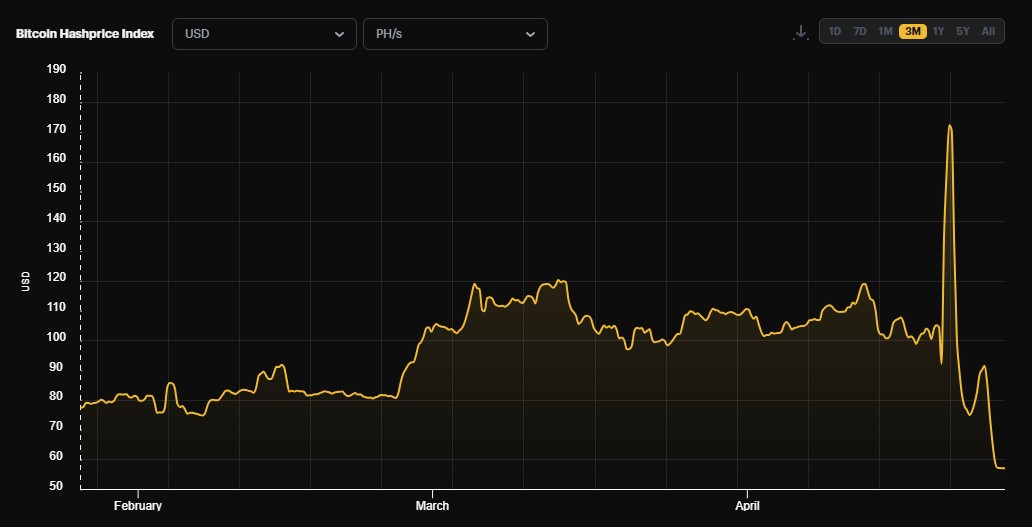

The key profitability indicator of mining the primary cryptocurrency, Bitcoin Hashprice Index, has closely approached its historical minimum. This comes against the backdrop of record mining difficulty growth after the halving and reduced transaction fees in the Bitcoin network. Bloomberg reports on this.

American mining company Luxor Technologies assesses the profitability of Bitcoin mining based on the computational power expended by devices for mining the primary cryptocurrency.

The indicator is called the Bitcoin Hashprice Index. As of April 25, the value of the Bitcoin Hashprice is $57, with a historical minimum of $55 recorded in November 2022 amid the collapse of the cryptocurrency exchange FTX.

Bitcoin Hashprice Index Source: Hashrate Index

The current value of the indicator indicates that a Bitcoin miner spending 1 petahash per second (PH/s) of computational power per day can earn $57. At its peak at the end of 2021, the indicator reached $3,500. Since the beginning of 2024 and until the halving, it ranged from $77 to $120.

The Bitcoin Hashprice indicator increases as the price of Bitcoin rises, as miners' profits increase. In addition to the price of Bitcoin, the value of the Bitcoin Hashprice is positively influenced by the increase in transaction fees in the Bitcoin network.

After the Bitcoin halving, which took place on April 20, the Hashprice briefly jumped to $139. On the night of the halving, the average fee in the Bitcoin network reached a record high of $128. This is attributed to the launch of the new Runes protocol by Casey Rodarmor, creator of the Ordinals protocol — an NFT analogue on the Bitcoin blockchain. However, by April 22, the transaction fee in the Bitcoin network had returned to pre-halving levels, and as of April 26, according to Bitinfocharts data, it stands at $12.

Bitcoin mining difficulty reached a historical record after the halving on April 24. The indicator increased by 1.99% to 88.10 T, according to BTC.com. It is forecasted that on May 7, the mining difficulty of the primary cryptocurrency will increase again to 88.29 T.

According to experts, to maintain competitiveness, miners will need to constantly increase investments in equipment. In early March, the American company Bitfarms announced that it would spend $240 million on purchasing more efficient equipment to adapt to the consequences of the halving.

Experts have calculated that the average cost of mining one Bitcoin in the fourth quarter of 2023 was approximately $29,500. It is expected that after the halving, this figure will rise to $53,000.

According to Bloomberg's surveyed experts, miners' losses after the halving are estimated at $10 billion. According to analysts at Bitwise Asset Management, the halving will lead to a reduction in Bitcoin emission rates by $11.5 billion.