The market crash has made Bitcoin mining unprofitable. Which devices are still profitable?

The cryptocurrency market crash has rendered Bitcoin mining equipment unprofitable.

The drop in Bitcoin's price has led to a new low in the profitability of mining the first cryptocurrency.

On the morning of August 5, Bitcoin's price briefly fell below $50,000. This was the lowest price since January 2024 and the sharpest price decline for the first cryptocurrency since 2021. As of 1:30 PM Moscow time on August 5, Bitcoin was priced at $51,406.

Following a more than 15% drop in Bitcoin's price over the past 24 hours, only five types of cryptocurrency mining devices remained profitable. This was reported by the mining pool F2pool.

According to F2pool's assessment, with Bitcoin's price above $52,000, the following devices remain profitable: Antminer S21 Hyd, Antminer S21, Antminer S19XP Hyd, Antminer S19XP, and Avalon A1466I. Operating all other devices at an electricity cost of $0.07 per kWh has become unprofitable due to the decline in Bitcoin's price and mining profitability.

Profitability Low

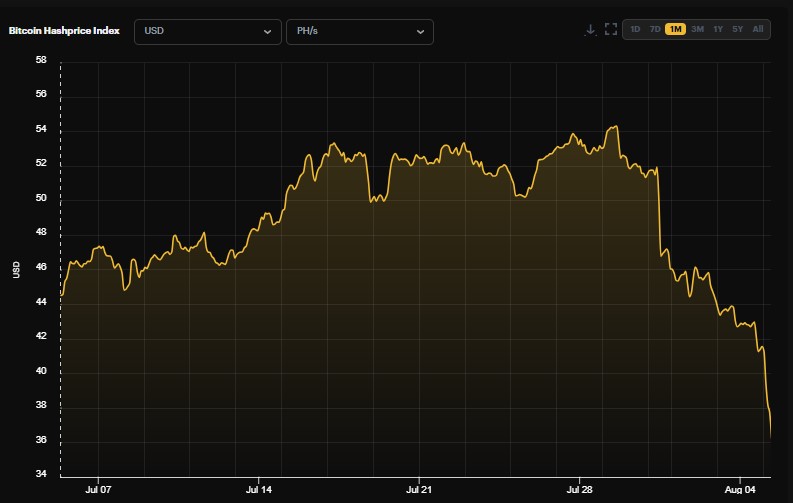

The Bitcoin mining profitability index has reached a new all-time low amid the cryptocurrency market crash.

Hashprice Index. Source: Luxor

The key profitability metric for Bitcoin mining, based on the computational power used by mining devices — the Bitcoin Hashprice Index — fell to a new all-time low of 36.08 on August 5. This metric was introduced by the American mining company Luxor Technologies.

The current value of the index indicates that a Bitcoin miner, using 1 petahash per second (PH/s) of computational power, can earn about $36 per day. The profitability of Bitcoin mining has steadily declined due to the drop in the first cryptocurrency's price and the reduction in mining rewards following the April halving.

At its peak in late 2021, the indicator reached $3,500. From the beginning of 2024 until the halving on April 20, it ranged from $77 to $120. After the halving, the index jumped to $139 due to high fees received by miners, but once the average fee size returned to normal, the hashprice value primarily declined.

Unfavorable Bitcoin mining conditions

Unfavorable Bitcoin mining conditions are forcing small miners to shut down their equipment, leading to an overall decline in the network's hashrate (the total power of miners' equipment). The average weekly Bitcoin network hashrate fell to 633.24 EH/s on August 5 from a record 667 EH/s at the beginning of the month.

According to experts, miners became the main source of selling pressure on Bitcoin in June, selling more than $1 billion worth of cryptocurrency. As a result, Bitcoin reserves held by miners fell to their lowest level since 2021. The leading American cryptocurrency miner, Marathon Digital, led the sell-off, with the Bitcoin sold in June accounting for 8% of its total reserves.

In July, major mining companies increased their capacity to mine the first cryptocurrency. Marathon Digital mined nearly 200 Bitcoin blocks in July, repeating a record not seen since December 2023. The company announced a shift to a strategy of accumulating and holding the first cryptocurrency and purchased Bitcoin worth $100 million on July 24.

Some experts believe that the decline in mining profitability at the current Bitcoin price and the shutdown of miners' equipment may lead to the formation of a local bottom, as selling pressure decreases.