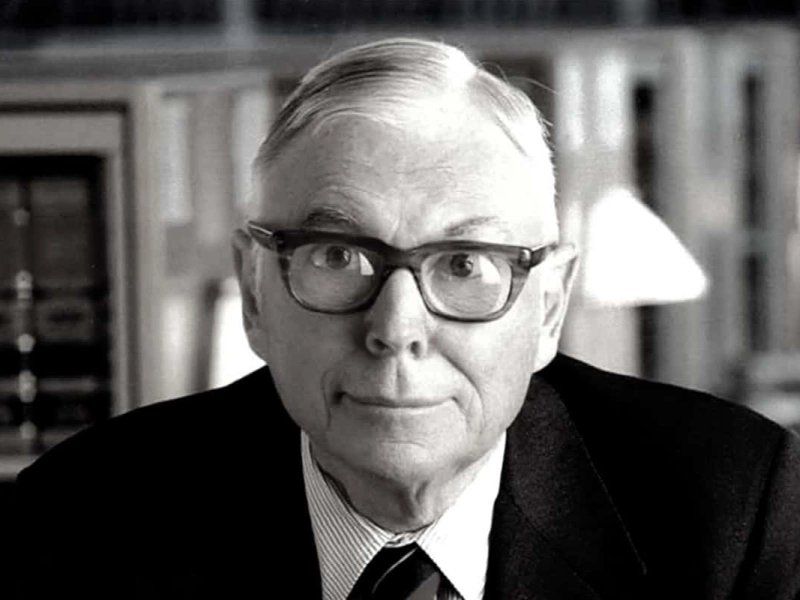

Warren Buffett's longtime associate called for a ban on cryptocurrency in the U.S.

Berkshire Hathaway's deputy chairman Charlie Munger attributed the success of many cryptocurrencies issued in recent years to gaps in the regulation of this area

Berkshire Hathaway's deputy chairman and Warren Buffett's longtime associate Charlie Munger called on the United States to follow China's lead and ban cryptocurrencies. In an article published in The Wall Street Journal, Munger attributed the success of cryptocurrencies to a regulatory gap.

Manger, 99, is a longtime critic of cryptocurrencies. In late 2021, he said he would never buy a cryptocurrency and called a complete ban on cryptocurrency transactions in China the right thing to do. In May of that year, the businessman called bitcoin "disgusting," and said he hated the success of the first cryptocurrency. In February 2020, the investor stressed that digital money had no value and compared it to an STD.

In a Feb. 1 article, Munger noted that private companies in the U.S. have issued thousands of cryptocurrencies in recent years and started selling them publicly without any government approval. In some cases, large numbers of tokens were sold for next to nothing to a promoter, and then people bought them at much higher prices, not realizing that the promoter was benefiting.

The success of such projects was made possible by the lack of regulation of cryptocurrencies, Munger said. He called for following China's example and legally banning cryptocurrencies, then thanking the Chinese communist leader for his "great example of unorthodox thinking."

"Cryptocurrency is a gamble with a near 100 percent advantage for the institution that runs it, conducted in a country where gambling has traditionally been regulated only by states that compete in laxity. Obviously, the U.S. must now pass a new federal law that will prevent this from happening," Munger wrote.

Buying bitcoin is speculation and gambling, not an investment, the multi-billionaire believes. He insists that cryptocurrency has no fundamental value and in most cases is used to move capital illegally.

- Ice storm forced Texas miners to stop mining cryptocurrency

- Santiment named the top 10 fastest-growing altcoins

- OKX says it is "100% clean" in securing customer assets

- Cryptocurrency lender Celsius announced the return of funds of some customers

- Hackers stole $8.8 million worth of cryptocurrency in the first month of the year

- Cryptocurrencies rose sharply in January.

_410x245_00e.webp)